8 Simple Techniques For Clark Wealth Partners

Table of ContentsThe 7-Second Trick For Clark Wealth PartnersNot known Incorrect Statements About Clark Wealth Partners The smart Trick of Clark Wealth Partners That Nobody is Talking AboutThe Ultimate Guide To Clark Wealth PartnersUnknown Facts About Clark Wealth PartnersClark Wealth Partners Things To Know Before You Get ThisFascination About Clark Wealth Partners

The world of money is a complicated one., for instance, lately located that nearly two-thirds of Americans were not able to pass a basic, five-question economic proficiency examination that quizzed individuals on subjects such as passion, debt, and other relatively standard concepts.Along with managing their existing customers, financial experts will frequently invest a reasonable quantity of time each week conference with potential clients and marketing their services to retain and expand their organization. For those thinking about becoming a monetary consultant, it is essential to think about the typical wage and task security for those working in the area.

Training courses in taxes, estate preparation, investments, and risk administration can be valuable for pupils on this path. Depending upon your distinct profession objectives, you may likewise need to gain details licenses to fulfill certain clients' demands, such as purchasing and marketing stocks, bonds, and insurance policy policies. It can also be handy to gain an accreditation such as a Licensed Economic Planner (CFP), Chartered Financial Analyst (CFA), or Personal Financial Expert (PFS).

What Does Clark Wealth Partners Do?

Many individuals make a decision to obtain assistance by using the solutions of an economic professional. What that resembles can be a variety of points, and can vary depending upon your age and phase of life. Before you do anything, research is essential. Some individuals stress that they require a particular amount of cash to invest before they can obtain assist from an expert.

The Of Clark Wealth Partners

If you haven't had any experience with a monetary advisor, here's what to anticipate: They'll start by providing a thorough assessment of where you stand with your possessions, obligations and whether you're fulfilling benchmarks contrasted to your peers for savings and retirement. They'll examine brief- and long-lasting goals. What's handy regarding this step is that it is individualized for you.

You're young and functioning complete time, have a car or two and there are student fundings to pay off.

Little Known Questions About Clark Wealth Partners.

You can go over the following ideal time for follow-up. Before you start, ask regarding rates. Financial consultants usually have various rates of prices. Some have minimum asset levels and will certainly charge a fee usually numerous thousand bucks for producing and changing a plan, or they may bill a flat cost.

You're looking in advance to your retired life and assisting your kids with higher education and learning costs. A financial consultant can use guidance for those situations and even more.

3 Simple Techniques For Clark Wealth Partners

That could not be the very best way to maintain building riches, specifically as you advance in your career. Schedule routine check-ins with your planner to modify your strategy as needed. Stabilizing financial savings for retirement and university prices for your kids can be complicated. An economic consultant can assist you focus on.

Thinking of when you can retire and what post-retirement years could appear like can create issues concerning whether your retirement cost savings are in line with your post-work strategies, or if you have actually conserved sufficient to leave a tradition. Assist your monetary professional recognize your method to money. If you are much more conventional with conserving (and prospective loss), their suggestions need to react to your fears and problems.

Clark Wealth Partners for Beginners

Preparing for health and wellness care is one of the large unknowns in retired life, and an economic professional can describe options and recommend whether additional insurance as protection may be handy. Before you start, attempt to obtain comfortable with the idea of sharing your entire economic picture with a professional.

Giving your professional a complete photo can assist them create a strategy that's prioritized to all components of your economic condition, especially as you're quick approaching your post-work years. If your finances are simple and you have a love for doing it yourself, you might be great by yourself.

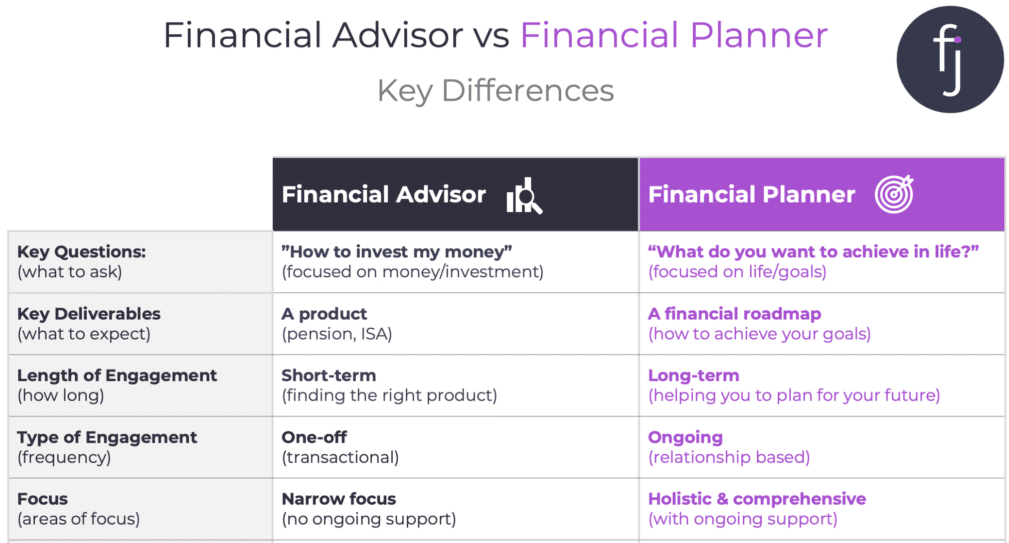

A financial advisor is not just for the super-rich; any person facing major life shifts, nearing retired life, or sensation bewildered by monetary choices might take advantage of professional assistance. This write-up checks out the duty of economic consultants, when you may require to seek advice from one, and vital considerations for picking - https://bizidex.com/en/clark-wealth-partners-finance-companies-839200. An economic consultant is a trained specialist that aids customers handle their financial resources and make informed decisions that straighten with their life goals

Fascination About Clark Wealth Partners

In comparison, commission-based experts make revenue with the monetary items they offer, which may affect their suggestions. Whether it is marriage, separation, the birth of a youngster, career adjustments, or check it out the loss of a loved one, these events have unique financial ramifications, commonly requiring timely choices that can have long-term results.